The FHA loan is popular among first-time homebuyers because of the low minimum credit scores and down payments. But that doesn’t mean it cannot be used by second-time homebuyers. In fact, 17% of FHA loans go to individuals that have already owned a home.

But the biggest issue with getting an FHA loan for a second home lies in the purpose of the property, and your planned occupancy in it. The FHA requires you to use the home as a primary residence for at least a year. There’s an even bigger issue if you’re planning to have two FHA loans at the same time. It can be a confusing tangle of information, but this article will help you figure your situation out.

Can You Use an FHA Loan if You Already Own a House?

With FHA loans allowing low credit scores, low down payments, and leniency in foreclosure or bankruptcy history, it has become a popular choice among first-time homebuyers with less-than-stellar financial history. But it is a myth that second-time (or more) homebuyers cannot get an FHA loan. So the answer is yes, you can qualify for an FHA loan even if you already own a house.

The only exception is if your previous house was also financed by an FHA loan. This is because the FHA only permits one loan at a time. In this case, you can get an FHA loan if you either finished paying your loan or sold off the mortgage, as long as you had 12 months of on-time payments on the first loan. However, exceptions exist wherein you can get a second FHA loan.

In the case that you are applying to have only one FHA loan, you can get the mortgage if you fulfill their requirements and occupy the home as your primary residence for at least a year.

Can You Get an FHA Loan After a Conventional Loan?

Yes, you can get an FHA loan after a conventional loan – however, it is important to remember that the FHA will only insure buyers that intend to use the home as a primary residence, so you cannot get an FHA loan if you intend to use it as a rental home, a second home, or an investment property.

If you qualify under this rule and their additional requirements, such as a DTI (Debt-to-Income) ratio of not more than 43% and a minimum credit score of 580. Lenders will want to make sure that you have the financial capability to qualify for the loan. If you prove this, you’re good to go.

Can A Second-Time Home Buyer Get an FHA Loan?

The short answer is yes!

If you bought a house before and are either still paying for it or sold it already, anyone who is financially qualified can apply for an FHA mortgage and get approved. It is not limited to first-time buyers or those in financial need.

FHA Second Home Loan Requirements

If you are availing for an FHA loan and you own another home that is not financed by the FHA, the requirements will look the same. Some of the most crucial FHA loan requirements are as follows:

- A credit score of at least 580 for a minimum down payment of 3.5%

- Paying for the Mortgage Insurance Premium (MIP) is required.

- Your Debt-to-Income (DTI) ratio must be less than 43%.

- The home must be the borrower’s primary residence for at least a year

- The borrower must have proof of employment and a stable income

The purpose of getting a second house is important due to the occupancy rule.

The occupancy rule states that the house must be occupied within 60 days after closing the deal and must be used as a primary residence for at least a year.

Of course, the 60-day rule may have exemptions if you are planning to get the FHA 203(k) loan. The renovations prompted by the loan may cause undesirable living conditions even after the 60-day rule. Regardless, you will need to live there for at least the majority of the year. This is why you cannot use the FHA loan for a vacation house, a rental property, a commercial estate, or a secondary home.

If you are planning to get an FHA loan regardless if you are already a homeowner or not, it’s a good to know where to get an FHA loan. This will help you know how much loan you qualify for and get all your documents in order.

How to Get a Second FHA Loan

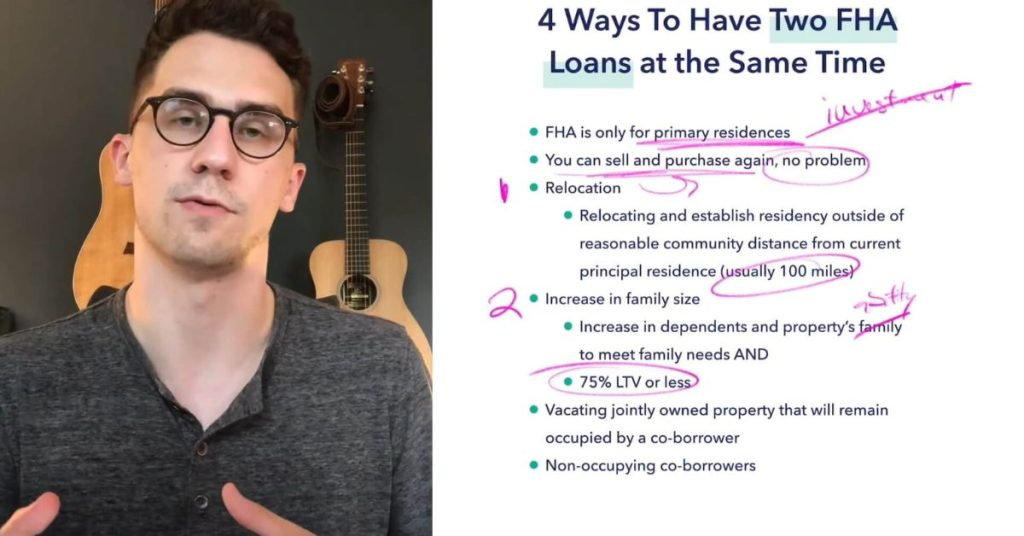

The FHA does not permit two loans at the same time but life happens and exceptions are made for certain scenarios.

These include:

- Relocating due to employment purposes

- Your family is growing too big and your home cannot accommodate the growing size

- Divorced couple that wants to move out of the current home

- You are a non-occupying co-borrower for someone else’s FHA loan and want to buy your own.

In the scenario that you will move to a bigger house due to a growing family, you will need at least 25% equity to be eligible for a second FHA loan. If you are able to get a second FHA loan, refinancing your first one can be an option. Refinancing allows you to transfer your loan into a new one that usually provides lower interest rates.

To Summarize

The FHA loan is not limited to first-time homebuyers.

Anyone who qualifies the requirements and intends to use the property as a primary residence can enjoy the perks of an FHA loan such as lower minimum credit scores, lower down payment requirements, and also more leniency if one has a history of foreclosure or bankruptcy.

However, two FHA loans at the same time are prohibited – unless you have extenuating circumstances.

It is only allowed in certain scenarios wherein the person has to relocate for job purposes or if the house becomes too small for a growing family. Being a divorced co-signer is also an exemption if one of the ex-spouses wants to move out. Being a non-occupying co-signer will also mean you can get another FHA loan.

Frequently Asked Questions

Can you get an FHA loan on a vacation home?

No, you can’t use the FHA loan for a vacation home since it is strictly meant for primary residences and has occupancy requirements to prevent you from deceiving them.

Can I buy a second home after FHA?

Yes, but not with another FHA loan since you can only have one at a time (except for a few exceptions). You can buy a second home with a conventional loan as long as you can prove financial capability in doing so.

What is an FHA secondary residence?

It is a house the borrower occupies in addition to their primary residence but less than a majority of the year. It is only possible if they fall under one of the exceptions of having one FHA loan at a time. This includes job relocation and a growing family.

What is the FHA 100-mile rule?

This rule pertains to individuals who request a secondary residence with an FHA loan. If they are planning to relocate due to employment-related reasons or want to establish a new primary residence, the secondary house must be at least 100 miles away from the primary property.