Bankruptcy can be a devastating and overwhelming experience.

Bankruptcy filings have been consistently high in recent years, with a significant number reported in 2024. So, you’re not alone. And your chances of securing a mortgage are still alive. Even with a bankruptcy on your financial records, it is still possible to get an FHA loan for your dream house.

This article will take you through everything you need to know about getting an FHA loan after bankruptcy and what to consider in the process.

Let’s get started.

What is an FHA Loan?

An FHA loan is a mortgage loan that is insured by the Federal Housing Administration (FHA). This means that the FHA guarantees the loan, which makes it less risky for lenders to offer to borrowers.

FHA offers refinancing options and home purchase plus renovation in their FHA 203k loan options, making them popular among first-time homebuyers since they require a lower down payment and have more lenient credit requirements than traditional loans.

Types of Bankruptcy

There are two common types of bankruptcy that individuals file for, namely, Chapter 7 and Chapter 13 bankruptcy.

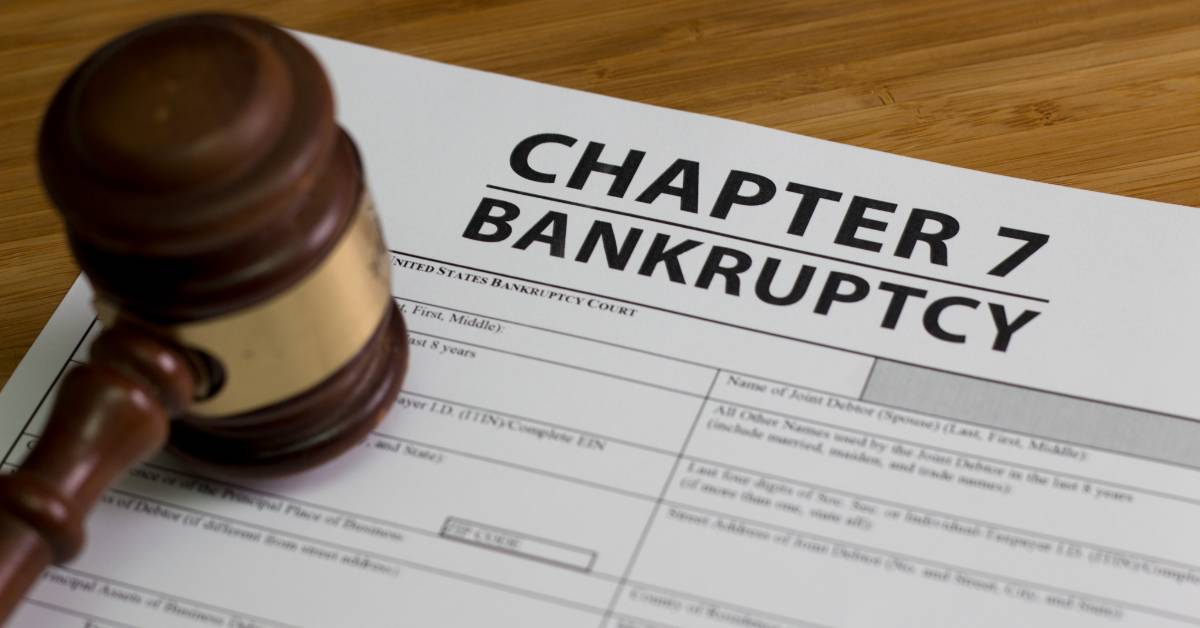

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is also known as “liquidation bankruptcy” because it involves selling off all of the debtor’s non-exempt assets to pay off creditors. This type of bankruptcy usually happens when you have no income or assets and cannot pay off your debts.

In a Chapter 7 bankruptcy, a trustee is appointed to oversee the sale of non-exempt assets, and the proceeds from the sale are used to pay off creditors. Once that is done, most remaining debts are discharged, which means one is no longer responsible for paying them.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as “reorganization bankruptcy”, involves creating a repayment plan to pay off creditors over three to five years. This type of bankruptcy is typically for anyone with a regular income and who can afford to pay back some of their debts over time.

For this kind of bankruptcy, you would work with a trustee to create a repayment plan based on your income and expenses. You would then make monthly payments to the trustee, who then distributes the funds to the creditors.

Once the repayment plan is complete, any remaining debts are discharged.

Can I Get an FHA Loan After Bankruptcy?

Yes. It is possible for you to get an FHA loan after bankruptcy, but it is definitely more challenging, whether it’s Chapter 7 or 13.

However, having a bankruptcy on your credit report may make it more difficult to qualify for an FHA loan and may result in higher interest rates and fees. There may also be additional requirements you take into account, such as a waiting period between bankruptcy and applying for an FHA loan.

It is crucial that in the time between your bankruptcy and your FHA loan application, you work as hard as you can to improve your credit. Not only will this make creditors more comfortable giving you an FHA loan, but it might also help you get more favorable terms and improve how much you can qualify for.

FHA Loan Requirements After Bankruptcy

To give you the best chance for success, we have compiled a list of requirements you will need to meet if you want to successfully get an FHA loan after bankruptcy.

Some of these are general requirements for an FHA loan, but some are bankruptcy specific. They include:

- Waiting period: After bankruptcy, there is a waiting period that you must meet before you can apply for an FHA loan after bankruptcy. The waiting period for a Chapter 7 bankruptcy is generally two years from the date of discharge, and for a Chapter 13 bankruptcy, one year from the date of discharge or one year from the start of the repayment plan, whichever is earlier.

- Credit score: The minimum credit score required for an FHA loan is typically 580. However, some lenders may require a higher score depending on your financial situation and credit history.

- Income: You must have a steady income to qualify for an FHA loan. Lenders will typically require proof of employment and income, such as pay stubs, tax returns, and bank statements.

- Debt-to-income ratio: The debt-to-income ratio is an important factor in determining your eligibility for an FHA loan. The FHA typically requires a debt-to-income ratio of 43% or less, although some lenders may allow a higher ratio depending on other factors.

- Down payment: The down payment required for an FHA loan is typically 3.5% of the purchase price of the home. However, some lenders may require a higher down payment depending on your financial situation.

- Bankruptcy counseling: You may be required to complete bankruptcy counseling before applying for an FHA loan. This counseling can help you better understand your financial situation and develop a plan for managing your finances in the future.

The table below compares the FHA loan requirements for borrowers with Chapter 7 and Chapter 13 bankruptcies:

| FHA Loan Requirements | Chapter 7 Bankruptcy | Chapter 13 Bankruptcy |

|---|---|---|

| Waiting Period | 2 years from discharge | 1-year of payment plan |

| Credit Score | Minimum 500 | Minimum 580 |

| Proof of Income | Required | Required |

| Debt-to-Income Ratio | Maximum 31%/43% | Maximum 31%/43% |

| Bankruptcy Discharge | Must be discharged | Must be in a payment plan |

| Approval from Court | Not required | Required |

| Documentation | Bankruptcy paperwork | Bankruptcy paperwork |

| Foreclosure | 3 years after | 1 year after |

| Short Sale | 3 years after | 1 year after |

| Loan Limits | FHA loan limits apply | FHA loan limits apply |

Remember that while these are some of the key requirements for an FHA loan after bankruptcy, individual lenders may have additional requirements or guidelines. If you’re looking to finance the purchase of a home in any of our service areas, then give us a call.

Can I get an FHA Loan after Chapter 7?

As established, the answer is, thankfully, yes. You can get an FHA loan after Chapter 7 bankruptcy, but there is a waiting period that you must meet before applying for the loan.

The waiting period for an FHA loan after Chapter 7 bankruptcy is generally two years from the date of discharge.

During this time, you should be working on rebuilding your credit, maintaining a steady employment history, and managing your finances responsibly to improve your chances of qualifying for an FHA loan.

FHA Loan Requirements after Chapter 7

We have listed the FHA loan requirements after bankruptcy and the same requirements stand for a Chapter 7 bankruptcy.

First, ensure that you can meet all the general FHA loan requirements, including the income, credit, DTI, and down payment requirements.

Then be sure to observe the waiting period and get bankruptcy counseling to help you plan your finances better for the future.

How Long After Chapter 7 Can I Get an FHA Loan?

You will need to wait at least two years before you can apply for an FHA loan.

Use the two years to stabilize yourself financially and improve your credit score. You can also work on decreasing your DTI, saving money for a down payment, and maintaining employment and a consistent income. This will increase your chances of getting approved for an FHA loan with favorable terms.

Can You Get an FHA Loan After Chapter 13?

If you have gone through a Chapter 13 bankruptcy and want to become a homeowner, yes, you can get an FHA loan even after a Chapter 13 bankruptcy.

However, you will have to wait at least one year between the date of discharge of the bankruptcy and the time of the FHA loan application.

In addition, you will need to meet other requirements to be eligible for an FHA loan, including a minimum credit score of 580 (although some lenders may require a higher score), a debt-to-income ratio of 43% or less and a down payment of at least 3.5% of the purchase price of the home.

Because you have a Chapter 13 bankruptcy on your financial record, lenders may also demand higher interest rates and fees, so work on your credit score, DTI, and employment to help you negotiate better terms for your loan.

Do I Have a Good Chance of Getting an FHA Loan After Bankruptcy?

If you have worked really hard to improve your financial situation, have met all other FHA loan requirements, and have observed the waiting period for your type of bankruptcy, you have a good chance of getting approved for an FHA loan.

We highly recommend you get together with your local lender or reach out to us to discuss your financial position and the FHA requirements. We are able to give you personalized advice and a competitive offer.

Frequently Asked Questions

How long after bankruptcy discharge can I apply for a mortgage?

It depends on the type of bankruptcy you filed. For a Chapter 7 bankruptcy, you can apply for a mortgage two years after the discharge. For a Chapter 13 bankruptcy, one year after the discharge or earlier if you have court approval.

How can you get an 800 credit score after bankruptcy?

Achieving an 800 credit score after bankruptcy may seem daunting, but it is not impossible. It requires patience, discipline, and a strategic approach to rebuilding your credit.

Here are some tips to help you get started:

- Pay your bills on time

- Keep your credit utilization low

- Monitor your credit report and dispute any errors

- Apply for new credit sparingly

- Use a secured credit card:

Remember that rebuilding your credit takes time and effort, but it is worth it in the end. With patience and persistence, you can achieve an 800 credit score after bankruptcy.

How long will bankruptcy affect me?

Bankruptcy can remain on your credit report for up to 10 years, depending on the type of bankruptcy filed. However, its impact on your credit score and ability to obtain credit can lessen over time as you rebuild your credit and demonstrate responsible financial behavior.

Can I get an FHA loan if I have filed for bankruptcy multiple times?

It is possible to get an FHA loan if you have filed for bankruptcy multiple times, but the waiting period may be longer than if you had only filed once.

In general, you will need to wait at least three years from the most recent bankruptcy discharge date to be eligible for an FHA loan. Plus, you will need to meet other eligibility requirements, such as having a minimum credit score and a debt-to-income ratio that meets FHA guidelines.